PLEASE NOTE: THIS IS A TWO PART EVENT; A SEMINAR ON DAY 1 (16 DECEMBER) FOLLOWED BY A WORKSHOP ON DAY 2 (17 DECEMBER). DETAILS FOR BOTH ARE BELOW.

CLaSP SEMINAR: 16 December (4-6 PM)

Debt by design: Opacity, automation, and inequality in Brazil’s credit and fintech industry with Dr Marie Kolling (Danish Institute for International Studies)

Brazil’s ‘fintech revolution’ has propelled the expansion of the digital economy and advanced financial inclusion, increasing access to consumer credit but also sparking record-high levels of household debt. Through multi-perspective fieldwork among women burdened by debt and professionals in the credit and fintech industry, the article examines three dimensions of opacity: (i) automated scoring models, (ii) flexible credit scoring criteria, and (iii) discretionary information in credit offers. The entrenchment of opacity generates a grey zone that limits women’s ability to assess and contest offers while myths thrive about how to navigate digital finance and improve creditworthiness. The insights challenge a narrative of financial education as a remedy to indebtedness, as deliberate information asymmetries forge debt by design.

NOTE: THE SEMINAR WILL BE FOLLOWED BY A WORKSHOP ON THE NEXT DAY, 17TH DECEMBER. PLEASE SEE BELOW FOR WORKSHOP DETAILS.

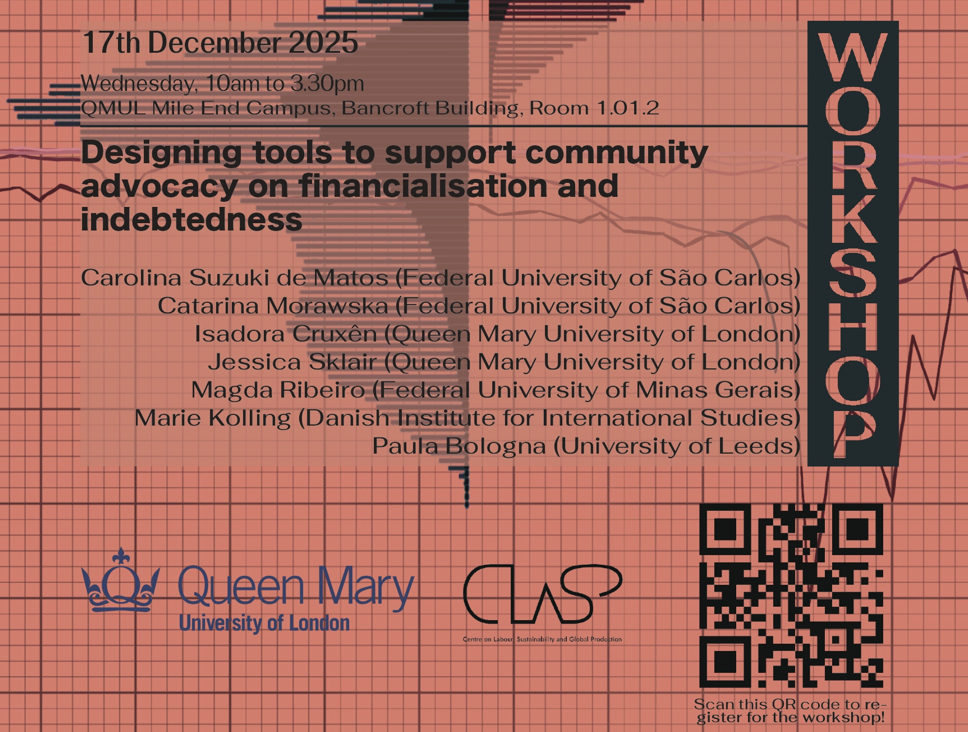

CLaSP WORKSHOP: 17 December (10AM-330PM)

Designing tools to support community advocacy on financialisation and indebtedness

Please scan here to register for this workshop!

Financial speculation has spread at unprecedented levels across the globe in recent years. In Brazil, the expansion of the credit market has triggered a debt crisis, leading the government to launch a debt renegotiation programme targeting 32 million people. The United Nations has recognised the threat posed to human rights by escalating levels of indebtedness, and in Brazil and elsewhere, civil society organisations are urgently calling for action. Drawing on learning from Brazil, this workshop will ask how data on credit and the effects of indebtedness can be put to use, to widen awareness on financialisation, debt and its drivers in different contexts. We will discuss existing data and debates on financialisation, and explore prototypes for the design of impact tools and advocacy strategies for resistance to debt.

Workshop programme:

10am-10.15am: Welcome and Coffee

10.15am-11.30am: Roundtable: Financialisation in the public debate

Moderator: Marie Kolling (DIIS)

Participants: Jessica Sklair (Queen Mary University of London) & Magda Ribeiro (Federal University of Minas Gerais)

11.30am – 11.45am: Break

11.45am - 1pm: Roundtable: Integrating quantitative and qualitative data for social impact

Moderator: Jessica Sklair (QMUL)

Participants: Catarina Morawska (Federal University of São Carlos), Isadora Cruxên (Queen Mary University of London) & Paula Bologna (University of Leeds)

1pm – 2pm: Lunch

2pm - 3.30pm: Tools for Impact: Producing a prototype

Marie Kolling (Danish Institute for International Studies) & Carolina Suzuki de Matos (Federal University of São Carlos)